The gross GST revenue collected in the month of March 2021 is at a record of ₹ 1,23,902 crore of which CGST is ₹ 22,973 crore, SGST is ₹ 29,329 crore, IGST is ₹ 62,842 crore (including ₹ 31,097 crore collected on import of goods) and Cess is ₹ 8,757 crore (including ₹ 935 crore collected on import of goods).

The government has settled ₹ 21,879 crore to CGST and ₹ 17,230 crore to SGST from IGST as regular settlement. In addition, Centre has also settled ₹ 28,000 crore as IGST ad-hoc settlement in the ratio of 50:50 between Centre and States/UTs. The total revenue of Centre and the States after regular and ad-hoc settlements in the month of March’ 2021 is ₹ 58,852 crore for CGST and ₹ 60,559 crore for the SGST. Centre has also released a compensation of ₹ 30,000 crore during the month of March 2021.

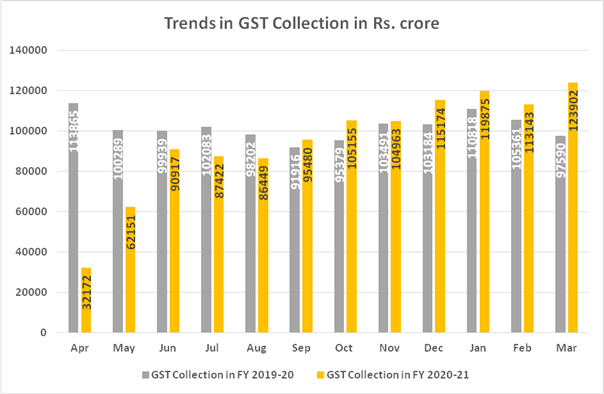

The GST revenues during March 2021 are the highest since introduction of GST. In line with the trend of recovery in the GST revenues over past five months, the revenues for the month of March 2021 are 27% higher than the GST revenues in the same month last year. During the month, revenues from import of goods was 70% higher and the revenues from domestic transaction (including import of services) are 17% higher than the revenues from these sources during the same month last year. The GST revenue witnessed growth rate of (-) 41%, (-) 8%, 8% and 14% in the first, second, third and fourth quarters of this financial year, respectively, as compared to the same period last year, clearly indicating the trend in recovery of GST revenues as well as the economy as a whole.

GST revenues crossed above ₹ 1 lakh crore mark at a stretch for the last six months and a steep increasing trend over this period are clear indicators of rapid economic recovery post pandemic. Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue over last few months.

- The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of March 2021 as compared to March 2020.

State-wise growth of GST Revenues during March 2021[1]

| State | Mar-20 | Mar-21 | Growth | |

| 1 | Jammu and Kashmir | 276.17 | 351.61 | 27% |

| 2 | Himachal Pradesh | 595.89 | 686.88 | 15% |

| 3 | Punjab | 1,180.81 | 1,361.85 | 15% |

| 4 | Chandigarh | 153.26 | 165.27 | 8% |

| 5 | Uttarakhand | 1,194.74 | 1,303.57 | 9% |

| 6 | Haryana | 4,874.29 | 5,709.60 | 17% |

| 7 | Delhi | 3,272.99 | 3,925.97 | 20% |

| 8 | Rajasthan | 2,820.44 | 3,351.79 | 19% |

| 9 | Uttar Pradesh | 5,293.72 | 6,265.01 | 18% |

| 10 | Bihar | 1,055.94 | 1,195.75 | 13% |

| 11 | Sikkim | 189.33 | 213.66 | 13% |

| 12 | Arunachal Pradesh | 66.71 | 92.03 | 38% |

| 13 | Nagaland | 38.75 | 45.48 | 17% |

| 14 | Manipur | 35.89 | 50.36 | 40% |

| 15 | Mizoram | 33.19 | 34.93 | 5% |

| 16 | Tripura | 67.1 | 87.9 | 31% |

| 17 | Meghalaya | 132.72 | 151.97 | 15% |

| 18 | Assam | 931.72 | 1,004.65 | 8% |

| 19 | West Bengal | 3,582.26 | 4,386.79 | 22% |

| 20 | Jharkhand | 2,049.43 | 2,416.13 | 18% |

| 21 | Odisha | 2,632.88 | 3,285.29 | 25% |

| 22 | Chhattisgarh | 2,093.17 | 2,544.13 | 22% |

| 23 | Madhya Pradesh | 2,407.40 | 2,728.49 | 13% |

| 24 | Gujarat | 6,820.46 | 8,197.04 | 20% |

| 25 | Daman and Diu | 94.91 | 3.29 | -97% |

| 26 | Dadra and Nagar Haveli | 168.89 | 288.49 | 71% |

| 27 | Maharashtra | 15,002.11 | 17,038.49 | 14% |

| 29 | Karnataka | 7,144.30 | 7,914.98 | 11% |

| 30 | Goa | 316.47 | 344.28 | 9% |

| 31 | Lakshadweep | 1.34 | 1.54 | 15% |

| 32 | Kerala | 1,475.25 | 1,827.94 | 24% |

| 33 | Tamil Nadu | 6,177.82 | 7,579.18 | 23% |

| 34 | Puducherry | 149.32 | 161.04 | 8% |

| 35 | Andaman and Nicobar Islands | 38.58 | 25.66 | -33% |

| 36 | Telangana | 3,562.56 | 4,166.42 | 17% |

| 37 | Andhra Pradesh | 2,548.13 | 2,685.09 | 5% |

| 38 | Ladakh | 0.84 | 13.67 | 1527% |

| 97 | Other Territory | 132.49 | 122.39 | -8% |

| 99 | Centre Jurisdiction | 81.48 | 141.12 | 73% |

| Grand Total | 78693.75 | 91869.7 | 17% |

[1] Does not include GST on import of goods

Indian Industry Plus A Pratisrutiplus Suppliment

Indian Industry Plus A Pratisrutiplus Suppliment