The Cabinet Committee on Economic Affairs chaired by Prime Minister Shri Narendra Modi approved the Fair and Remunerative Price (FRP) of sugarcane for Sugar Season 2024-25 at ₹ 340/quintal at sugar recovery rate of 10.25%. This is historic price of sugarcane which is about 8% higher than FRP of sugarcane for current season 2023-24. The revised FRP will be applicable ...

Read More »Author Archives: IIPnews

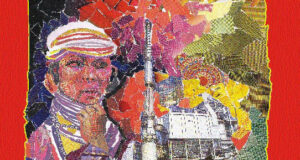

ODISHA THE LAND OF OPPORTUNITIES

A 3600 APPROACH Odisha has become a destination for investors and entrepreneurs from across the globe to create value for all the stakeholders (business, community, working class) by leveraging several advantages that Odisha offers. The state has industry-friendly policies, enabling infrastructure, and ensures swift and agile administration to enriching experience for the industry players. The state has been able to ...

Read More »The FDI policy reform will enhance Ease of Doing Business in the country, leading to greater FDI inflows and thereby contributing to growth of investment, income and employment

The Union Cabinet chaired by Prime Minister Shri Narendra Modi approved the amendment in Foreign Direct Investment (FDI) policy on space sector. Now, the satellites sub-sector has been divided into three different activities with defined limits for foreign investment in each such sector. The Indian Space Policy 2023 was notified as an overarching, composite and dynamic framework to implement the vision for ...

Read More »Quality Council of India and Open Network for Digital Commerce launch DigiReady Certification Portal to empower MSMEs and small retailers

As our nation’s backbone, the Micro, Small, and Medium Enterprises (MSME) sector plays a pivotal role in fostering employment opportunities and reducing regional imbalances. In a significant stride towards fostering digital inclusion in the MSME sector, the Quality Council of India (QCI) and Open Network for Digital Commerce (ONDC) are proud to announce the launch of the DigiReady Certification (DRC) ...

Read More »Coal Sector Achieves Impressive 10.6 % Growth in December Among Eight Core Industries

The coal sector has showcased highest growth of 10.6 % (provisional) among the eight core industries for the month of December 2023 as per the Index of Eight Core Industries (ICI)) (Base Year 2011-12) released by Ministry of Commerce & Industries. The index of coal industry has reached 204.0 points during Dec’23 as compared to 184.4 points during the same ...

Read More »South Eastern Coalfields Ltd Plans to Develop Solar Power Projects of 600 MW

South Eastern Coalfields Ltd (SECL), one of the largest coal-producing subsidiaries of Coal India Ltd, will be developing rooftop and ground mounted solar power projects of 600 MW capacity in the coming years as part of the company’s strategy to expand and diversify its business and achieve the “Net Zero Energy” goal. The strategy is in line with the larger ...

Read More »DPIIT notifies Quality Control Orders for ‘Potable water bottles’ and ‘Flame-Producing Lighter’

Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce & Industry has successfully notified two new Quality Control Orders (QCOs) on July 5, 2023. These QCOs on ‘Potable Water Bottles’ and ‘Flame-Producing Lighters’ will come into effect six months from the date of notification. These QCOs aim to strengthen the quality ecosystem in India and enhance public ...

Read More »‘Intense momentum marks the opening day of Startup20’s third meeting in Goa Over 250 International, National delegates participate on Day One

The Startup20 Engagement Group of the G20 kicked off its third meeting, the Goa Sankalpana, with an atmosphere of unwavering energy and determination today in Goa. The day commenced with the presentation of the eagerly anticipated Policy Communiqué, followed by a series of engaging sessions and addresses, driving the conversation on startup innovation and collaboration. The morning session commenced with ...

Read More »NALCO surpasses past production records, posts Net Profit of Rs. 1544 crore and Clocks all time High Revenue from Operations at Rs.14, 255 crore in FY 22-23

National Aluminium Company Limited (NALCO), the Navratna CPSE, under the Ministry of Mines, Government of India,has reported robust performance across all its business units, with best-ever annual production and sales during the Financial Year 2022-23. According to the financial results, taken on record in the Board of Directors meeting held today, NALCO has posted a net profit of Rs. 1544 ...

Read More »National Campaign for Updation and Verification of People’s Biodiversity Register Launched in Goa

The National Campaign for Updation and Verification of People’s Biodiversity Register (PBR) was launched in Goa today, marking a significant step towards the documentation and preservation of India’s rich biological diversity. The function, organized by the Union Ministry of Environment, Forest and Climate Change, in association with the Goa State Biodiversity Board, the National Biodiversity Authority, and the Government of ...

Read More » Indian Industry Plus A Pratisrutiplus Suppliment

Indian Industry Plus A Pratisrutiplus Suppliment