GST e-invoice system, the game changer in the GST system, has successfully completed journey of six months. During this period more than 39.81 Crores e-invoices have been generated by 88,000+ suppliers. There are more than 47 lakh recipients involved in these transactions, who will be receiving Input Tax Credits easily. On 31st March 2021, 37.42 Lakh e-Invoices are generated which is the highest for a day in last 6 months.

E-invoice system was launched on 1st Oct 2020 for the tax payers whose annual aggregate turnover is more than Rs 500 Crores and subsequently on 1st Jan 2021, the tax payers whose annual aggregate turnover is between Rs. 100 Crores and Rs. 500 Crores have been enabled. From 1st April 2021, as per the government order, tax payers whose annual aggregate turnover is between Rs. 50 Crores and Rs. 100 Crores are mandated to generate e-invoice from the portal. National Information Centre (NIC) has already enabled these tax payers on the portal and is geared up to handle the generation of e-invoices by the tax payers.

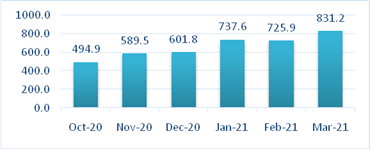

e-Invoice Statistics (In Lakhs)

NIC has taken pro-active measures in educating the tax payers about the common errors while reporting the e-invoice to the IRP(Invoice Registration Portal). Daily emails are sentwith the details of the errors and telephonic calls are made to the taxpayers with large number of errors. The tax payers can note the errors sent by mail and take appropriate corrective measures with the help of their IT teams.

In addition to API based e-invoice generation mode, NIC has provided the offline Excel based IRN preparation and printing tool, called as NIC-GePP tool for the tax payers. This application is helping the tax payers to enter the invoice details, prepare the file to upload on NIC IRP portal, download the IRN(Invoice Reference Number) with QR code and print the e-invoice with QR code.

Continuing its efforts to make the ease of doing the business, NIC has developed a new tool by which the tax payers can prepare and generate the e-invoices using mobile and web based form. This app will help the small tax payers in generation of the e-invoice through their mobiles. This app is under testing and will be released soon.

Indian Industry Plus A Pratisrutiplus Suppliment

Indian Industry Plus A Pratisrutiplus Suppliment