- The Government will examine suggestions of further opening up of FDI in aviation, media (animation, AVGC) and insurance sectors in consultation with all stakeholders.

- 100% Foreign Direct Investment (FDI) will be permitted for insurance intermediaries.

- Local sourcing norms will be eased for FDI in Single Brand Retail sector.

Global Foreign Direct Investment (FDI) flows slid by 13% in 2018, to USD 1.3 trillion from USD 1.5 trillion the previous year – the third consecutive annual decline, according to UNCTAD’s World Investment Report 2019.

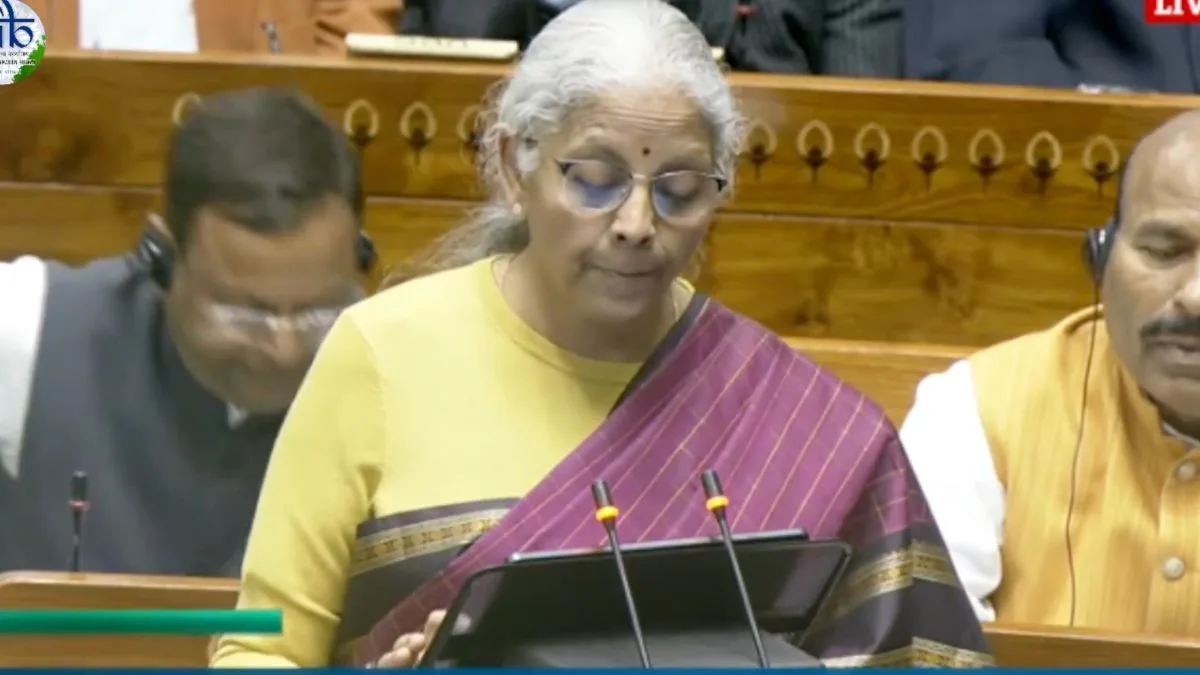

The Finance Minister further stated that it is high time India not only gets integrated into global value chain of production of goods and services, but also become part of the global financial system to mobilise global savings, mostly institutionalized in pension, insurance and sovereign wealth funds. Nirmala Sitharaman informed that the Government is contemplating organizing an annual Global Investors Meet in India, using National Infrastructure Investment Fund (NIIF) as the anchor, to get all three sets of global players-top industrialists/corporate honchos, top pension/insurance/sovereign wealth funds and top digital technology/venture funds.

An important determinant of attracting cross-border investments is availability of investible stock to the Foreign Portfolio Investors (FPIs). This issue assumes greater significance in view of the gradual shift, from stock targeted investments, towards passive investment whereby funds track global indices composition of which depends upon available floating stock. Accordingly, the Finance Minister proposed to increase the statutory limit for FPI investment in a company from 24% to sectoral foreign investment limit with option given to the concerned corporates to limit it to a lower threshold. FPIs will be permitted to subscribe to listed debt securities issued by ReITs and InvITs.

The Finance Minister in her Budget speech underlined that as Foreign Portfolio Investors are a key source of capital to the Indian economy, it is important to ensure a harmonized and hassle free investment experience for them. She proposed to rationalize and streamline the existing Know Your Customer (KYC) norms for FPIs to make it more investor friendly without compromising the integrity of cross-border capital flows.

Indian Industry Plus A Pratisrutiplus Suppliment

Indian Industry Plus A Pratisrutiplus Suppliment